If you’re struggling to get on the property ladder, there are more ways than ever to get started. Here at Platform, we’re huge advocates for affordable home ownership and ensuring that buyers have every opportunity to find their dream home.

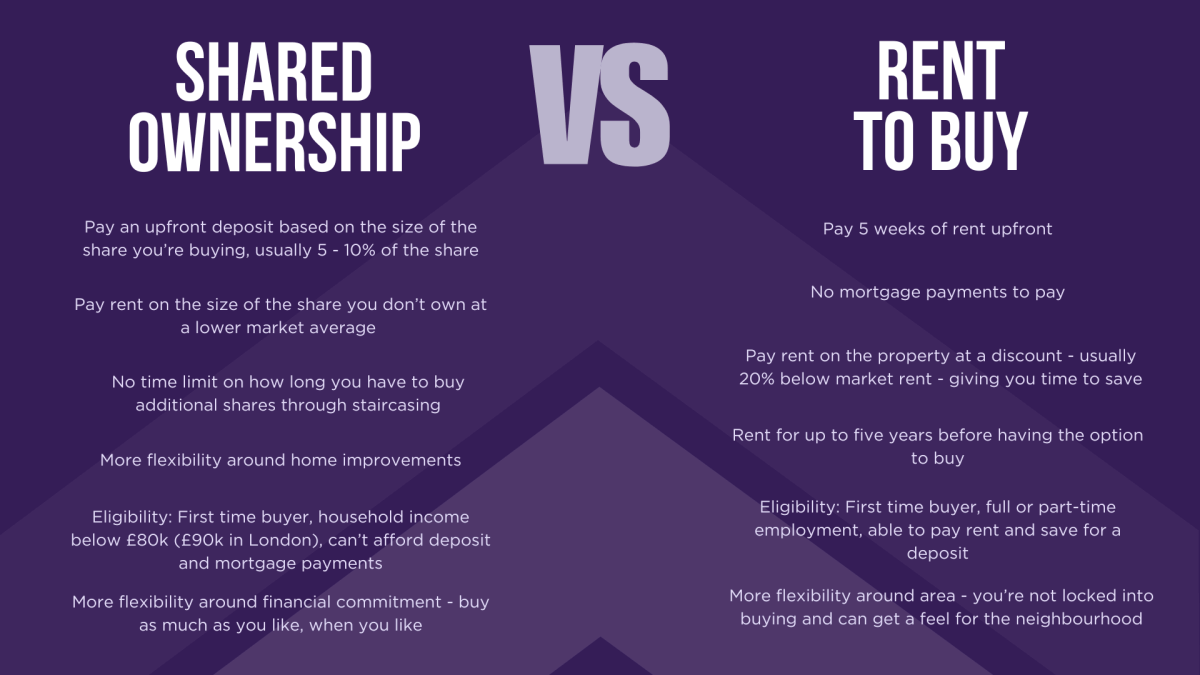

While schemes such as Help to Buy were previously the top choice, we’ve now seen a shift towards two key products: Shared Ownership and Rent to Buy. Both offer different pros and cons depending on your circumstances, but it can be overwhelming working out what’s right for you.

If you're looking for the differences between shared ownership versus rent to buy - and what is better in 2026 - read on to find out more.

What’s the difference between Shared Ownership and Rent to Buy?

Before we discuss the various merits of each scheme, let’s get a breakdown of what each scheme offers and how they work.

Shared Ownership: Shared Ownership schemes work on the basis that you buy a share of a specific shared ownership property and pay mortgage payments based on the size of your share. You also pay rent on the half that you don’t own but this is offered at a lower-than-market average by the housing association you buy with.

Typically, the mortgage payment and subsidised rent payment are cheaper than renting a home and the initial access to entry is much lower - since you’re only buying a share rather than the full value of the home, the deposit is much lower. You can increase your share of the property at any time via staircasing, to eventually reach full ownership.

Rent to Buy: The Rent to Buy scheme is more straightforward than Shared Ownership and works more like private renting but with the end goal of buying the property. When you move into a Rent to Buy property, you rent it on an Assured Shorthold Tenancy basis for five years. During this time, you pay rent each month at 80% of the market value and the other 20% goes towards a deposit that you use at the end of the five-year tenancy.

Shared Ownership vs Rent to Buy: Which is Better in 2026?

When you’re choosing an affordable home ownership scheme, it’s important to take note of your finances, the length of time you’re looking to stay within the property and the various pros and cons of each scheme.

While elements of each scheme may change over time, we're looking at both Shared Ownership and Rent to Buy as they are today. With that in mind, here is a breakdown of the various considerations you might want to consider:

Home Improvements

A key part of home ownership is making the space your own, which is often a common complaint by private renters; they’re limited in what they can do to the property.

Shared Ownership homes generally allow the buyer to make broader home improvements than a Rent to Buy property would.

You can generally make improvements to a Shared Ownership property provided it's not structural. This means that decorating walls, putting up pictures, moving things around or changing flooring is typically fine, although it’s important to check with your provider to confirm what you can and can’t do.

Just remember, when you make adjustments, you may change the market value, which can impact staircasing and selling values.

If you’re looking to kickstart your interior design dreams, you may be better suited to a Shared Ownership property.

Upfront Cost

One of the largest differences between the two schemes is the initial cost of the property purchase. Shared Ownership requires a larger initial financial commitment as you’re putting down a deposit on the share of the property you’re purchasing.

While this is significantly lower than buying at full market value (usually 5% - 10% of the share rather than 5% - 10% of the entire value of the house), it’s still more than Rent to Buy which is simply an initial rental payment as you would through standard private rental properties.

The initial cost associated with Shared Ownership does mean you own a part of the property and acts as an initial step to full home ownership. While the upfront cost may be higher, you’re already one step closer to owning the property than you would be at the same point with Rent to Buy.

Time

The option you choose may also depend on how much time you have - or need - to get financially ready. When you choose Rent to Buy, you have the option to buy at a predetermined point in the contract - usually after five years.

During this time, you have the opportunity to save up for a deposit or improve your credit before you attempt to secure a mortgage. This isn’t the same as Shared Ownership; where you need the credit, or initial deposit, to secure a mortgage immediately.

It’s important to remember that if your circumstances change during the Rent to Buy period, however, you may find yourself unable to buy the property in the future. Likewise, you’re not locked into a purchase point when you enter the scheme - if prices go up you may be paying more than you thought.

Flexibility

Both schemes offer certain degrees of flexibility, although in different ways. Buying a home through Shared Ownership offers flexibility in the sense that you can begin the staircasing process at a point when you feel comfortable. You’re not locked into any time commitments and you can buy as big or as little a share as you’d like each time, ensuring financial flexibility for buyers.

Rent to Buy provides flexibility in the sense that you’re able to test out the property before you commit to any long-term decisions. You’re able to get a feel for the home, the neighbourhood and the local lifestyle before you take the plunge and buy.

Stability

If you’re concerned about stability, Shared Ownership is generally a safer option. Since you’re buying a portion of the home from the outset with Shared Ownership, you have the stability of knowing that you’re already on the way to full home ownership and you can increase the size of the share at any time.

Rent to Buy offers less stability and acts more as a transition scheme between private renting and property purchase. While you always have the option to buy during the tenancy, it does require you to have your financial position in order by the time the tenancy ends, otherwise, you may find yourself unable to buy.

Ultimately, the choice you make depends on your financial position and how much you feel comfortable putting towards your home purchase. Shared Ownership offers incremental steps to home ownership and is generally much more affordable from the outset due to buying shares rather than the full market value. Rent to Buy is ideal if you're looking to transition from private renting to home ownership and need time to get a deposit or credit rating together.

Both schemes are excellent alternatives to a traditional, outright purchase but have varying pros and cons you’ll want to consider. If you want to discuss your position more, get in touch with us at Platform here.