As part of our ongoing commitment to providing you with everything you need to know about UK property, we’re introducing the Platform Property Market Update, reviewed quarterly to make sure you’re up-to-date and in the know.

The UK housing market has defied expectations as we progress through Q2 2023. With demand for homes at the highest levels they’ve been since October last year, buyer activity is being supported by falling mortgage rates and strong employment. Below we explore some of the latest headlines for the property market and what we can expect over the next three months.

Buyers flock back to the UK housing market

At the time of writing, demand is 16% higher than at the same point in 2019 and over the last two weeks, buyer interest has returned to its highest level since the introduction of the mini-budget impacted the market in October 2022.

Every area in the country is seeing improvements and the most in-demand areas are those that are typically more affordable such as the North East, Scotland and Wales. As you might expect, the areas that have seen lower demand are either more expensive or saw significant price increases during the pandemic.

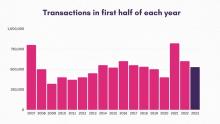

UK on track for 500,000 completions in the first half of 2023

Zoopla research suggests that the UK may see 500,000 completions during the first 6 months of this year. While new sales can take several months to become a complete sale and some deals may fall through, this also indicates that the UK may sell 1 million homes during 2023.

In general, this first half performance is outperforming the same period between 2008 and 2013, highlighting the positive sentiment rippling through the market.

Transactions reveal positive market movement

One of the key indicators of how the market is performing is the number of transactions occurring - homes being sold ‘subject to contract’.

The ‘sales agreed’ continue to rise and despite being 16% lower than 2022, they’re 11% higher than 2019 levels.

A major contributor to this is that there are more properties available on the market. The chronic undersupply of homes available in 2022 may have helped push prices up but it meant that completions dragged.

There are now 65% more homes for sale than 2022 and according to Zoopla, the average estate agent has 25 homes available compared to 14 last year. Overall, this is a positive change and gives people more choice as well as ensuring that sellers price their property sensibly.

What can we expect going forward?

The main takeaway from the first quarter of 2023 is that the housing market is in a better condition than most people expected towards the end of last year.

While the market is experiencing soft price corrections, activity is continuing on a positive trajectory and both buyers and sellers are agreeing on deals.

Going forward, the markets that offer the best affordability will attract demand and likely see a higher level of activity. For sellers, it’s vital that pricing aligns with the market and what buyers would expect - in this current market, they can’t afford to overprice their homes.

If we focus on the Shared Ownership market, the outlook is positive. SO lending remains strong and as with the broader market, affordability is key in high-volume markets during the cost-of-living crisis. Fortunately, lenders continue to have confidence in the market and the number of products available are exceptional.